Listen to this story.

Listen to this story.

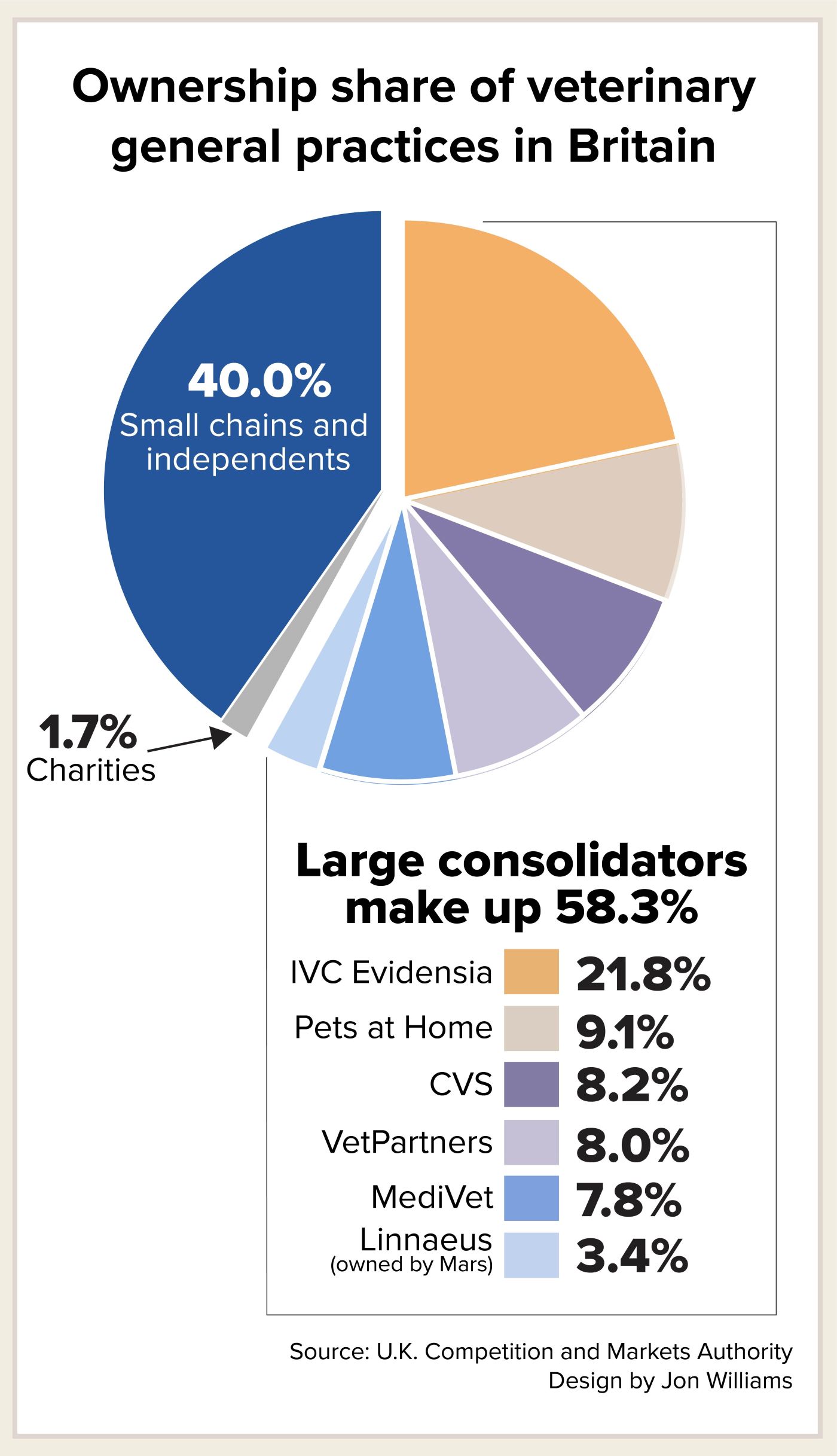

Pie chart

Authorities in the United Kingdom have raised the possibility of imposing a cap on veterinary prescription fees and forcing large companies to sell veterinary practices, in a sobering assessment of competition levels that sent one corporate consolidator's share price tumbling.

With the publication Tuesday of results from a provisional analysis, the U.K. Competition and Markets Authority (CMA) said it would launch a formal "market investigation" into the country's veterinary sector, conditional on the outcome of a public comment period that ends April 11. A market investigation would then take 18 to 24 months.

The agency's actions could influence thinking among regulators in other countries such as Australia, France and the United States, which likewise are contending with the rising influence of private equity firms and other big players in a veterinary profession once dominated by small, independent businesses.

The deepening probe in the U.K. comes after an initial six-month review by the CMA that was spurred, in part, by a spike in the cost of veterinary care that has outpaced inflation. The first review drew more than 56,000 comments, including around 45,000 from the public and 11,000 from the veterinary community.

While the CMA could have ended its probe after the initial review, the agency said that it identified "multiple concerns," including that ownership concentration could be leading pet owners to overpay. It also found that consumers weren't always given sufficient information about pricing and practice branding to make informed choices.

A formal market investigation, the CMA explained, would allow it to compel those being investigated to provide information. Should it identify anticompetitive behavior, legally enforceable demands could include "mandating the provision of certain information to consumers, imposing maximum prescription fees and ordering the sale or disposal of a business or assets," the CMA said. (Prescription fees are charged by veterinarians when pet owners elect to purchase treatments from a third-party provider).

In a sign that the formal investigation could undermine consolidators' growth ambitions, shares in CVS Group, which owns about 500 practices, mostly in the U.K., closed 25% lower on the London Stock Exchange on Tuesday. The shares fell another 1.4% on Wednesday.

CVS said in a market filing that it and several other consolidators had "put forward a package of possible remedies" to address the regulator's concerns. These include more clearly communicating prices and who owns practices to clients. "CVS continues to believe this package could be adopted across the market and could address the CMA's concerns more quickly than an 18-month investigation," the company said.

Shares in Pets at Home, which owns hundreds of veterinary practices and pet stores in the U.K., also fell, but by only 3.6% on Tuesday before rebounding 2.3% on Wednesday. The company said its business has unique characteristics that make the probe of less concern to its investors. Pets at Home typically builds practices rather than acquiring existing ones, and it allows veterinarians to own a 50% stake in the practices. The veterinarians have "complete clinical autonomy and set pricing at the local level," the company said.

Other large consolidators in the U.K. — namely, Mars Inc., IVC Evidensia, VetPartners and MediVet — aren't listed on a stock market. The CMA noted that consolidators now own a combined nearly 60% of veterinary practices in the U.K., up from around 10% in 2013.

Competition concerns identified in 40% of geographic areas

In a sign of the potential scope of its enforcement actions, the CMA provided a heat map of the U.K. by postal code. Of 2,831 regions, it identified 1,134 that might have "competition concerns." Those with potential competition issues comprise 330 districts where a large corporation owns at least two primary care practices and has a market share above 30%, and 804 districts where there is a single practice with no competitor.

The regulator also found that most veterinary practices don't display prices on their website and that clients aren't always informed of the cost of treatment before agreeing to a procedure. It noted that some consolidators don't change the name or branding of independent practices they buy, giving consumers the illusion of choice.

Moreover, the CMA worries that pet owners aren't always aware that they don't have to buy medications from their veterinarian. "While it can be convenient to buy a medicine directly from the vet as part of a consultation, around 25% of pet owners did not know that getting a prescription filled elsewhere was an option — meaning they are missing out on potential savings, even with the prescription fee," it said.

Regarding concerns about the rising cost of care overall, some consolidators have noted that various factors are behind it, including an apparent shortage of veterinarians and demands for more sophisticated care.

The British Veterinary Association, which represents more than 19,000 veterinarians, reiterated Tuesday a concern that the general public may have unrealistic expectations about the cost of veterinary care because human health care in the U.K. is subsidized through the country's National Health Service.

"Rising prices are a concern for everyone, but it's vital to recognize there is no NHS for pets," Dr. Anna Judson, BVA president, said in a statement. Judson said prices charged by veterinarians reflect investment in medical equipment, supplies and medicines "whether they are employed by corporate or independently owned practices."

Veterinarians, she noted, have complained of a rise in abuse from clients as a result of the probe, putting more stress on stretched teams. "It's important to remember that vets enter this high-pressure profession out of genuine care for animals and will always prioritize their health and welfare," she said.

Still, Judson acknowledged the importance of animal owners having "as wide a choice of vet practices as possible."

For its part, the CMA accepted that various factors affect pricing. "We have heard concerns from those working in the sector about the pressures they face, including acute staff shortages ..." its chief executive, Sarah Cardell, said in a statement. "But our review has identified multiple concerns with the market that we think should be investigated further."

Calls grow for changes to law

One aspect of the CMA's announcement that was welcomed by both the BVA and the Royal College of Veterinary Surgeons, the industry's professional regulator, was its call for an overhaul of British law pertaining to veterinary medicine.

The country's Veterinary Surgeons Act dates to 1966, before non-veterinarians were able to own practices. Consequently, the RCVS can regulate only individual veterinarians, not veterinary practices.

Allowing the RCVS to regulate practices is among a raft of changes to the Veterinary Surgeons Act proposed by the RCVS — changes that include more controversial recommendations, such as allowing veterinary nurses to perform cat castrations "under veterinary direction and supervision" and prescribe some medications.

The government, though, has yet to prepare new legislation and allocate time for a parliamentary vote on the proposed changes.

"Having contributed to the CMA's work to review the vet sector over the past six months, we welcome its recommendation to modernize our regulatory framework through new legislation, something we have been calling on government for, for over 20 years," the RCVS said in a statement.